are closed end funds safe

5 Bargain Funds with Safe 87 Dividends. Ill show you t.

What Are Closed End Funds 3 Risks That Destroy Wealth Finance Advice Bond Funds Fund

So for instance a CEF that is valued at 10 may.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

. If the closed-end fund reaches its termination date and the fund still has a discount of 10 for instance it would be prudent for everyone in the fund to vote to close it so that they can capture that immediate extra 10 risk free return and then reinvest in something else or restart the fund. Instead I suggest investors sell those stocks and give these safer closed-end funds a look. What you dont see in these funds can kill your portfolio though.

This can result in. Along the same lines consider the shares of the Nuveen Credit Strategies Income Fund JQC 654 when looking for. Example 2 Aberdeen India Fund IFN The Aberdeen India Fund has a long history of wild discountpremium swings.

Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. As such the India Fund was trading at a huge 35 discount to NAV. On the surface theres a lot to like about closed end funds.

A closed-end fund or CEF is an investment company that is managed by an investment firm. Closed-end funds are actively managed by a fund manager often use financial leverage to generate more income can invest in various assets eg. They arent safe if they are overvalued and I believe they are by as much as 30.

Closed-end funds CEFs can be one solution with yields averaging 673. Unlike with open-end mutual funds a closed-end fund manager does not face reinvestment risk from daily share issuance. Look for Discounts and Premiums.

Closed-end funds offer excellent income potential compared to conventional mutual funds ETFs and dividend stocks but come with a number of complexities. A closed-end fund manager does not have to hold excess cash to meet redemptions. Closed-end funds raise a certain amount of money through an initial public.

Closed-end fund definition. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and 60. There is still risk of course but I think these closed-end funds have strategies that are less risky than large-cap dividend stocks.

Closed-end funds use of leverage can be relatively safe if the underlying assets are of high quality and have volatility of around 3 to 4 commensurate with stable assets such as high. The term closed-end fund CEF is a bit of a double entendre. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility.

For income investors closed-end funds remain an attractive investment class that covers a variety of asset classes and promise. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can. You would have been much better off owning the index and occasionally selling shares to fund your income needs especially after considering the fact that the closed-end fund distribution is likely to be cut during a bear market in many cases or return part of your capital as a distribution and closed-end funds particularly those employing leverage typically perform.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. Part of the Wells Fargo Advantage Funds family EAD is a closed-end fund that invests in the fixed-income markets via junk bonds preferred stock and other instruments that bring higher risk but. Closed-End Funds Carry Less Risk.

Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below. Stocks bonds and trade at a discount or premium to the market value of. In many cases leverage in these assets is viewed as a foregone conclusion what investors must accept in exchange for 8-12 distributions.

A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering IPO to raise capital for its. Just like open-ended funds closed-end funds are subject to market movements and volatility. Closed-end funds are similar to mutual funds and exchange-traded funds.

The 13 Best Books for Beginning Investors. In the late 1990s and early 2000s nobody wanted to hold emerging markets and everyone wanted to hold US. An unintended one Im sure and one we can leverage for safe 6 7 and even 8 yields with upside to.

You can get a big discount to the value of the fund and a higher dividend than comparable funds. In this video Im revealing the three hidden dangers in closed end funds that destroy wealth. Their yields range from 632 on average for bond CEFs to.

Balanced Funds Investment Companies Investing Fund Management

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

Advantages And Disadvantages Of Etfs

What Is A Closed End Fund The Abcs Of Cefs Kiplinger Dividend Stocks Fund Stock Funds

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

Understanding Closed End Vs Open End Funds What S The Difference

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

Open Your Eyes To Closed End Funds

Open Ended And Evergreen Funds In Venture Capital Toptal

What Is A Close Ended Funds A Close Ended Fund Also Called Closed End Investment And Closed End Mutual Fund It Is A Type O Finance Blog Mutuals Funds Fund

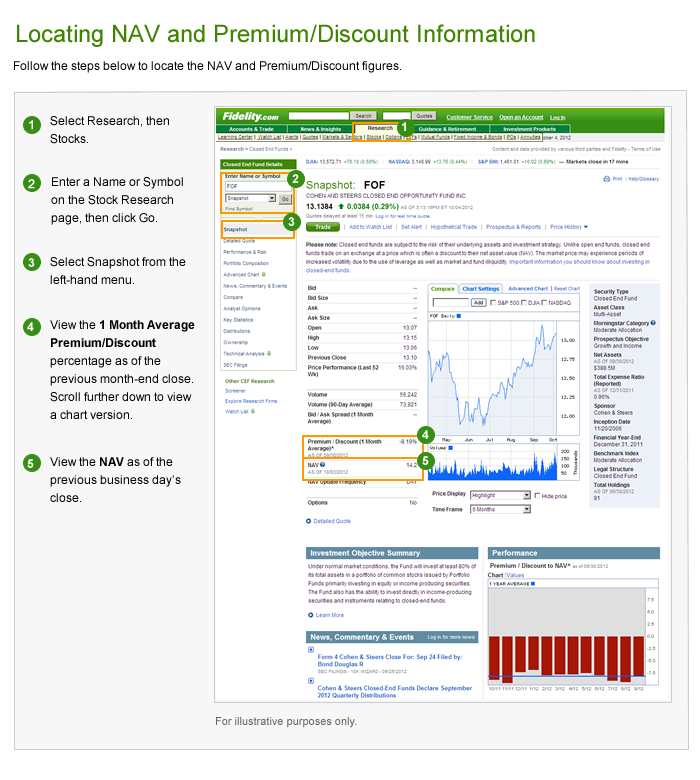

What Are Closed End Funds Fidelity

Closed End Fund Cef Discounts And Premiums Fidelity

Difference Between Open Ended And Closed Ended Mutual Funds

The 2 Best Monthly Dividend Stocks Free Bonus Strategy The Money Snowball Dividend Stocks Investing Apps Dividend

Open Ended And Closed Ended Mutual Funds Right Fund For You Closed End Or Open End Fund Youtube

Difference Between Open Ended And Closed Ended Mutual Funds

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

What Is A Closed End Fund And Should You Invest In One Nerdwallet