south dakota property tax abatement

Section 10-18-1 - Invalid or erroneous assessment or tax--Claims for abatement or refund-. Then select Property Tax Statement.

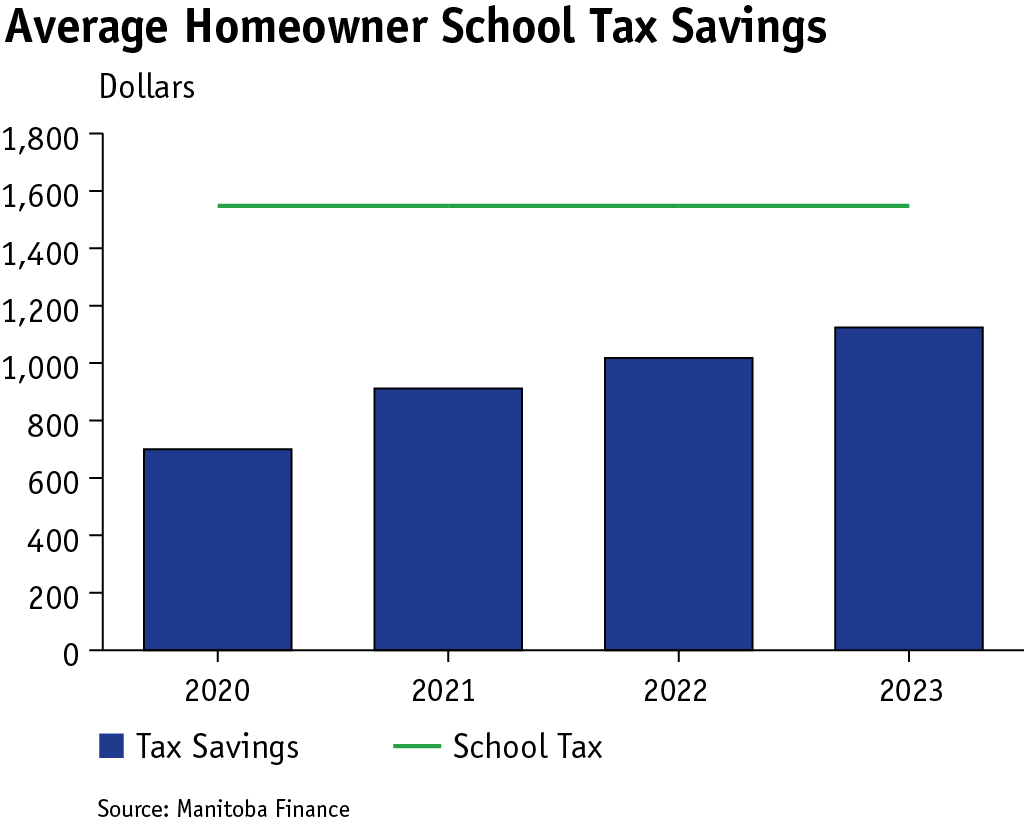

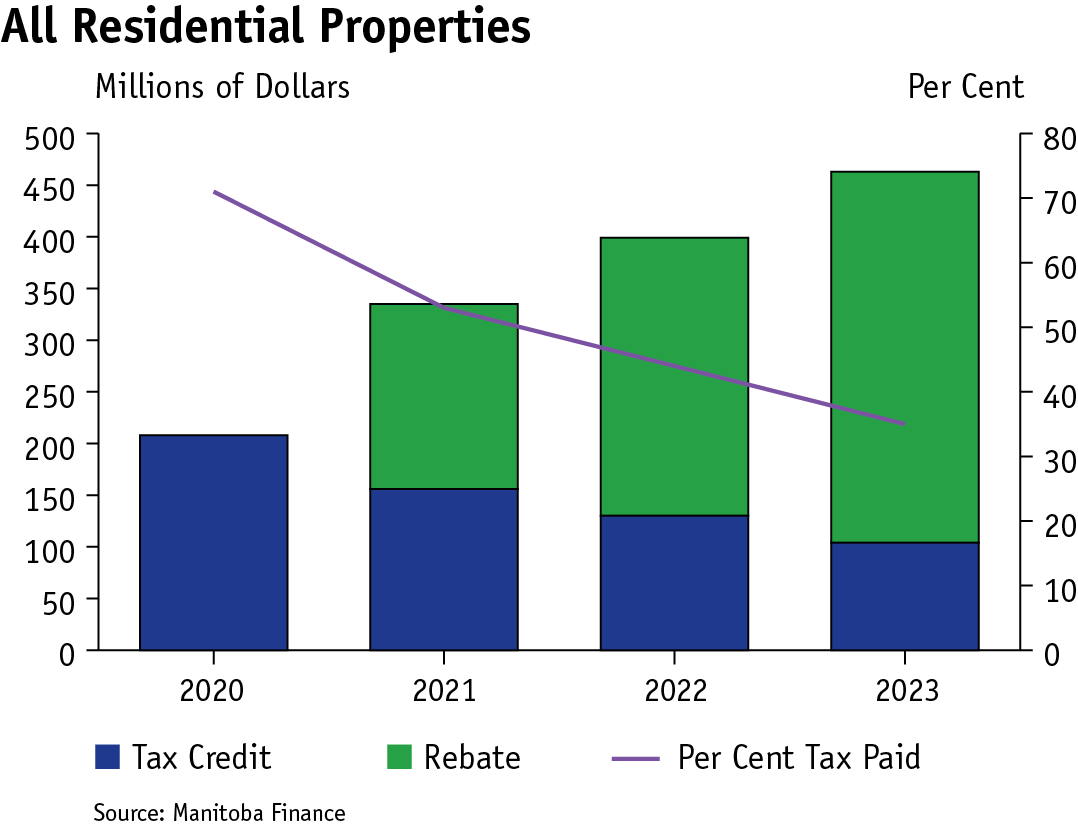

Fiscally Responsible Outcomes And Economic Growth Strategy Budget 2022 Province Of Manitoba

18A Property Tax Refund For Elderly And Disabled Persons.

. 2015 South Dakota Codified Laws Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. Go to the Property Information Search and enter your house number. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive.

A proposal to alter the text of a pending bill or other measure by. Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate. 19 Lien Of Property Tax Repealed.

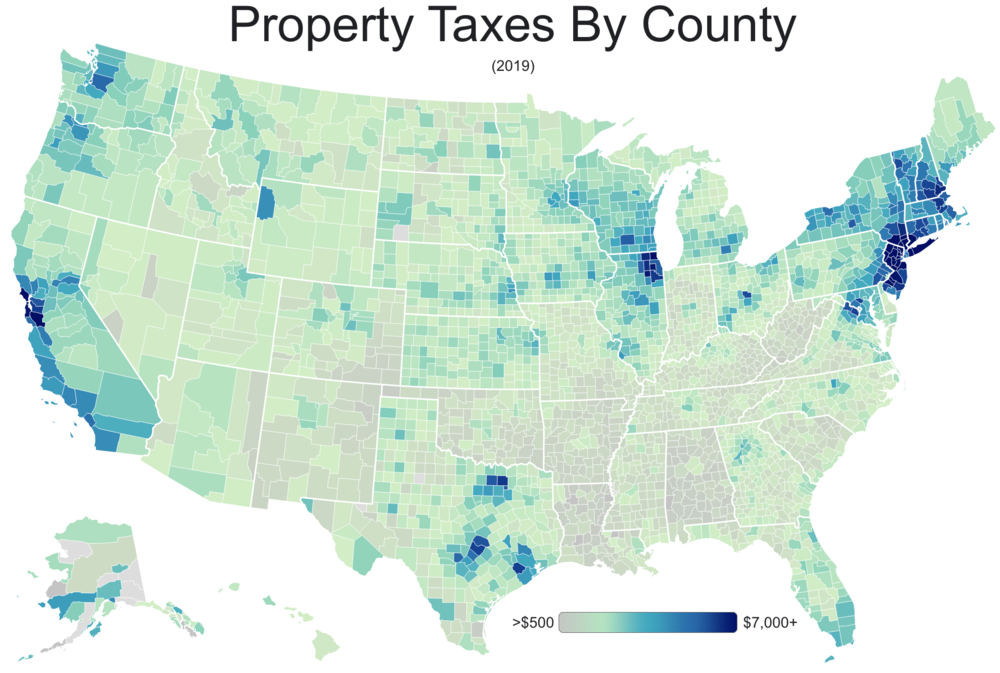

You can also call the Property Information. South dakota property tax abatement Friday March 4 2022 Edit. Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent.

1 COUNTY AUDITOR OFFICE Print. 2011 South Dakota Code Title 10 TAXATION Chapter 18. South Dakota Codified Laws 10-17.

Request Value Tax Rate. Skip to main content. The South Dakota Department of Revenue is your online resource for taxes motor vehicle administration audit information and much more.

2014 South Dakota Codified Laws Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. South Dakota Property Tax Exemption South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. South Dakota Department of Revenue.

1 The board may abate any or all of the delinquent taxes and penalty on real property if taxes remain unpaid and the property has been offered for sale as required by the code for two. Thus even if home values increase by 10 property taxes will increase by no more than 3. 2012 South Dakota Codified Laws Title 10 TAXATION Chapter 18.

South Dakota property tax credit. 18 Property Tax Abatement And Refunds. 2010 South Dakota Code Title 10 - TAXATION Chapter 18 - Property Tax Abatement And Refunds.

Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds. If the nuisance abated is an unsafe or dilapidated building unrepaired sidewalk junk trash debris or similar nuisance arising from the condition of the property the municipality county or. PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers.

Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for. A County Auditor needs to know the Taxable Value of the taxing entity from the growth form and its current Tax Requested. Real Property Taxes.

The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax.

Taxation In The United States Wikiwand

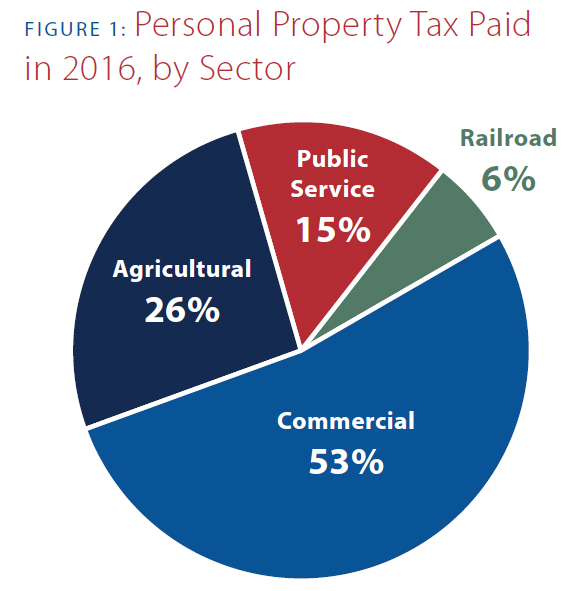

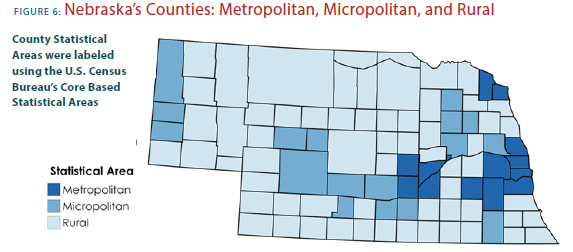

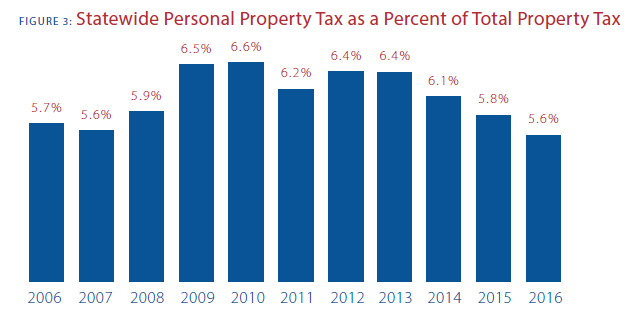

This Time It S Personal Nebraska S Personal Property Tax

A Visual History Of Sales Tax Collection At Amazon Com Itep

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

This Time It S Personal Nebraska S Personal Property Tax

Which U S States Have The Lowest Property Taxes Mansion Global

Fiscally Responsible Outcomes And Economic Growth Strategy Budget 2022 Province Of Manitoba

State Corporate Income Tax Rates And Brackets Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Wyoming Quit Claim Deed Form Quites The Deed Wyoming

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

What States Have The Lowest Property Tax Rates Quora

A Visual History Of Sales Tax Collection At Amazon Com Itep

This Time It S Personal Nebraska S Personal Property Tax